As you see clients fret over attracting and retaining employees while balancing the bottom line, there's a solution they may not have considered: supplemental insurance.

Because supplemental insurance can fill the gaps left by medical insurance — saddling employees with high deductibles and out-of-pocket costs — such coverage offers a financial benefit that far exceeds the cost of a premium. That's important for workers who are trying to recover from a health event or accident, as it means they get to hold on to more of their hard-earned money.

And because these plans are usually paid for by the employee, they don't create a financial burden for your client. Instead, supplemental health coverage can provide peace of mind while sending a strong message that your client cares about their workers' well-being and financial health.

What is supplemental health insurance?

Supplemental health insurance is separate insurance designed to cover expenses that are not included in the employee's primary health insurance or to offset out-of-pocket costs. These policies may offer additional coverages for hospital stays or one-time payouts for certain illnesses; they might cover services and expenses that fall outside the primary policy.

How do supplemental policies help business owners?

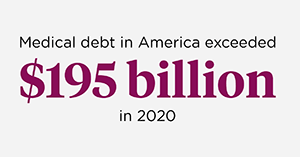

Health care costs are high and can be difficult to manage. Depending on the type of policy held, there could be significant deductibles to meet before insurance even kicks in. Many health insurance policies don't include dental or vision coverage, and almost all require a co-pay of some kind.

Supplemental policies plug the gaps that could otherwise mean unsurmountable medical bills and debt. These add-on policies are typically low-cost, which means the employee can take advantage of the protection without a significant investment. Some help pay deductibles and co-pays or cover the cost of dental visits and glasses. These benefits show the commitment of the employer to the employees. They can help retain top talent and provide peace of mind that can make for a more positive and productive working environment.

Is offering supplemental insurance worth it?