How medical stop loss helps

business owners sleep at night

Reducing operating costs is on the minds of many business owners,1 and the ever-increasing medical plan premiums on many fully insured plans are worrisome. The Society of Human Resource Management (SHRM) anticipates 5.6% higher costs for employer-provided medical plans in 2023.2

Reducing costs shouldn't have to come at the expense of employee needs. Health insurance coverage is usually the key benefit that employees want when deciding to work for an employer. It can be the deciding factor for attracting the best workers to a company.

Self-funding an employee health care plan is a cost-reducing strategy your business clients may want to consider. When employers self-fund their medical plan, they have greater control over what is included in the plan with more specialty medical management options. Plus, there are often fewer fees and expenses compared to a fully insured group health insurance plan. However, a self-funded health plan comes with more risk than a fully insured plan. For example, a catastrophic employee medical claim could result in a huge liability for an employer. Medical stop loss insurance can provide the peace of mind your business clients need to reduce their worry a bit and sleep better at night.

What is medical stop loss insurance?

Medical stop loss insurance protects employers who self-fund their employee medical plan against unexpected medical costs over a specified limit. Purchasing stop loss insurance means the employer has an added layer of protection for claims costs over a deductible amount (called the specific deductible) determined by their policy — whether for one specific medical event or a collection of claims that together exceed the deductible (called the group attachment point).

A company with generally healthy employees could be presented with a claim for a life-threatening injury or illness that results in medical bills exceeding the business' entire claims reserves. Medical stop loss insurance helps to alleviate that financial risk to the business and preserve the business' cash flow and assets.

How it works

Consider a midsize business that has a self-funded health plan for its employees and their dependents as an example. If just a few employees or their covered family members develop cancer or require a transplant, their treatment will probably result in hundreds of thousands of dollars in medical care claims. If the employer has a stop loss plan in place, it is protected from these costs, mitigating the risk of a catastrophic financial loss. The claims costs are capped at their deductible amount with the costs in excess of that limit covered by the medical stop loss carrier.

Many businesses are self-funding and purchasing medical stop loss insurance

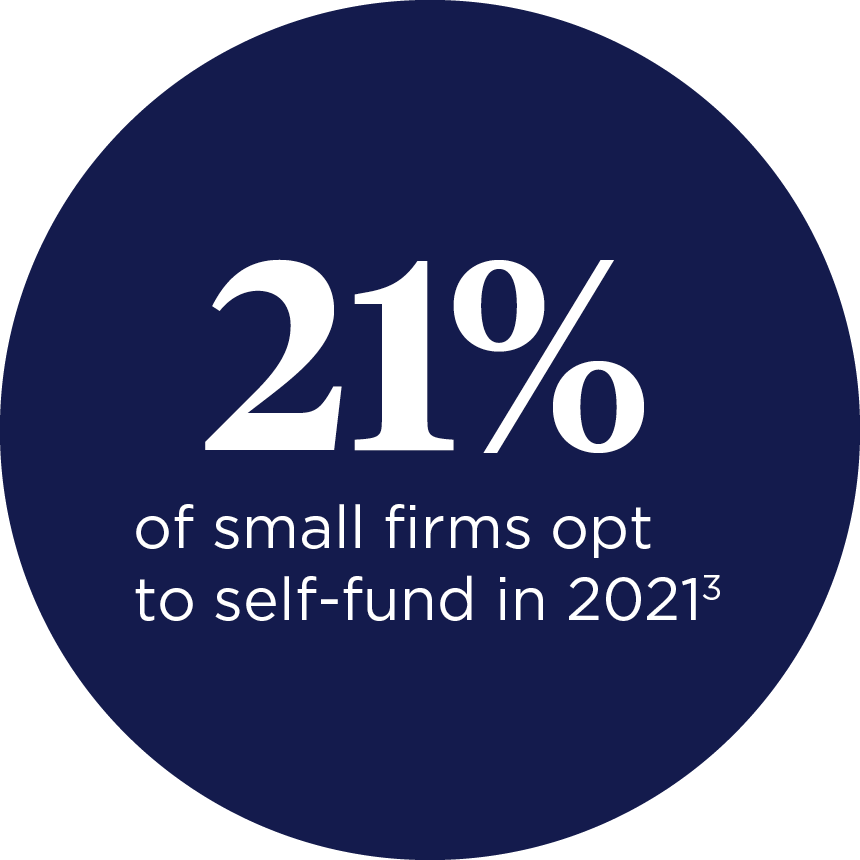

Self-funding a business' medical plan is becoming a cost-effective solution for ever smaller businesses. Many small to midsize businesses provide health insurance for their employees. A small but growing number are moving to self-funded health plans, with 21% of small firms (between 3 and 199 employees) opting to self-fund in 2021,3 up from 13% in 2018.4

How you can help your business clients

Talking about financial risks and exposures can enhance your value to your business clients. While reducing operating costs are top of mind to many business owners,1 few are adequately assessing the financial risks that could impact their costs, and even fewer are engaging with a professional on solutions. Initiate a conversation with your business clients to understand how moving to a self-funded health plan with medical stop loss could help them to take control, manage the risk and reduce the expenses of their employee medical plan.

Call 1-888-674-0385 or email stoploss@nationwide.com to get started.

[1] 55% of small business owners reducing operating expenses," Diverse Small-Business Owner Survey, Hispanic Chamber of Commerce (July 2022).

[2] Medical plan costs expected to see bigger rise in 2023," SHRM (August 2022).

[3] KFF Employer Health Benefits Survey 2021 (November 2021).

[4] KFF Employer Health Benefits Survey (2018-2020); Kaiser/HRET Survey of Employer-Sponsored Health Benefits (1999-2017).