The economics of Social Security

Even before 2020, there were questions about the solvency of Social Security. Add growing levels of political gridlock preventing needed improvements to the program’s viability, and it may come as no surprise that 6 in 10 Americans worry about the Social Security program running out of funding during their lifetime.1 While benefits won’t stop altogether, they may be reduced at some point during your clients’ retirements. Take steps now to help your clients protect their retirement paycheck and soften the blow of any benefit reductions in the years ahead.

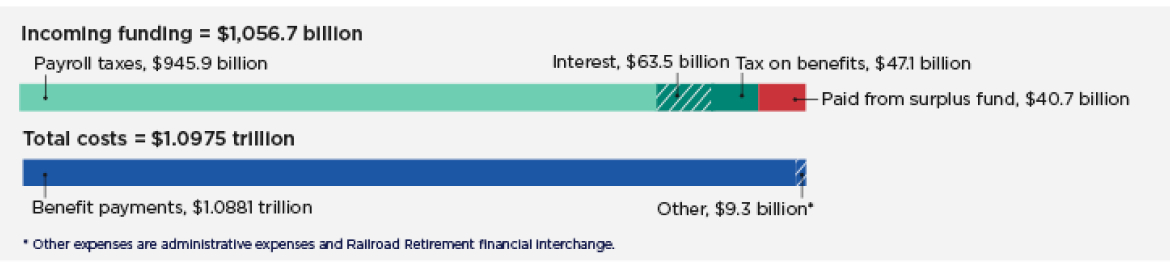

Social Security is primarily financed through a dedicated payroll tax. There are also 2 other sources that fund this pool of money:

- Taxes on some recipients’ benefits

- Interest earned on the pool of money

Social Security (OASI Trust Fund) funding and output, 20222

For decades, the pool of money was greater than the amount of money paid out in the form of benefits. As a result, there is also a surplus fund. But beginning in 2021, due to increased longevity and a decrease in the number of workers per beneficiary, Social Security began tapping into the surplus fund to meet its obligations.

If changes are not made to the existing system, the surplus fund will be depleted by 2034. The original pool of money will still be funded by payroll taxes, benefit taxes and interest, but beneficiaries would begin receiving reduced benefits.

The latest Board of Trustees report estimates that benefits will remain fully payable until at least 2033, with 77% of benefits payable through 2097.2

These estimates assume that everything stays the same. But it’s more likely that Congress will pass amendments to help address Social Security’s long-term funding shortfalls. Unless and until that happens, however, your clients can prepare by taking action.

Actionable steps clients can take

1

Understand what their essential income needs will be during retirement. A retirement income worksheet can help.

2

Plan in advance for a potentially reduced amount of Social Security benefits. Save in taxable, tax-deferred and tax-free accounts so they have the flexibility to minimize their taxes in retirement.

3

Plan in advance for a potentially reduced amount of Social Security benefits. Save in taxable, tax-deferred and tax-free accounts so they have the flexibility to minimize their taxes in retirement.

[1] “The Nationwide Retirement Institute 2022 Social Security survey,” conducted by The Harris Poll on behalf of the Nationwide Retirement Institute. This online survey was conducted April 25 - May 23, 2022, among 1,853 U.S. adults age 26 or older.

[2] “The 2023 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds,” Social Security Administration (March 2023).

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Please read the contract for complete details. Protections and guarantees are subject to the claims-paying ability of the life insurance company. Consult with your financial professional for more information.

All annuity contract and rider guarantees, or annuity payout rates, are the sole obligations of and backed by the claims-paying ability of the issuing insurance company. They are not obligations of or backed by the broker/dealer from which this annuity is purchased, by the insurance agency from which this annuity is purchased or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.

This material should be regarded as educational information on Social Security and is not intended to provide specific advice. If you have questions regarding your particular situation, you should contact the Social Security Administration and/or your legal or tax advisors.

Nationwide Investment Services Corporation (NISC), member FINRA, Columbus, Ohio. Nationwide Retirement Institute is a division of NISC.