5 ways to reduce your income taxes

To potentially lower your income taxes, enroll or contribute more to your retirement plan today.

Payday is always great but seeing how much of your pay goes toward taxes can be deflating.

While paying taxes on your income may be painful, it serves an important purpose. Taxes help governments fund social services and pay for things you use every day, such as parks, roads and public transportation.

Now, for the good news: You can reduce your income taxes in simple ways, including those listed below.

1. Save for retirement

Yes, saving for the future can help you trim today’s tax bill. Every dollar you contribute to an eligible retirement account reduces the amount of income that you have to pay taxes on.

Here’s how it works: You put a portion of your income into a qualified account, such as one your employer offers. If your contributions go in before taxes are taken out, saving for retirement in that account can lower your taxable income.

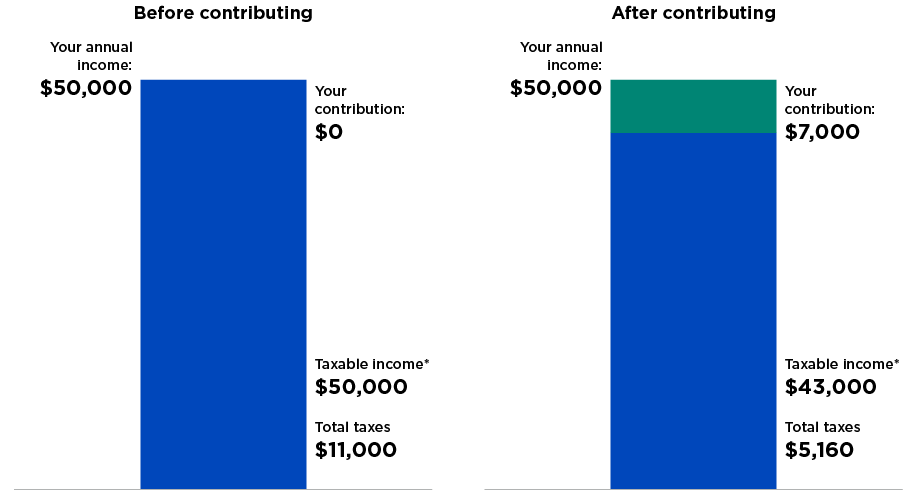

Let’s say you make $50,000 a year, and you contribute 14% of your pretax income (or $7,000 annually) to your retirement account. Here’s how that would impact your 2024 federal income taxes if you were a single filer using the standard deduction:

In this example, your retirement account contributions reduce your annual income taxes by $840. You benefit by investing in your future and are rewarded with lower taxes today.

There’s another benefit: Typically, the money you put into the account, as well as any earnings your investments make, won’t be taxed until you withdraw it at retirement. If you’re in a lower income tax bracket when you retire, you may be taxed at a lower rate on those withdrawals.

Keep in mind that in some cases, saving for retirement won’t lower your current taxable income. Contributing to a Roth IRA or a Roth account in your retirement plan doesn’t because the money you contribute to this type of account has already been taxed. However, you will not be taxed on the withdrawals or the investment earnings if you’ve owned the account for at least 5 years and are 59 1/2 or older. It’s a trade-off: Investing in a Roth reduces the taxes you’ll pay when you retire, but it doesn’t lower your income taxes today.

*before standard deduction

2. Give to charity

You can also potentially reduce your income taxes by making charitable donations. Keep accurate records of how much you donate and to which organizations. You may be able to use those donations as a tax deduction at the end of the year.

You’ll need to itemize deductions on your tax return to do so. If you make a donation of $300 or more, you’ll probably need paperwork from the charity confirming your gift. In certain situations, you can donate shares of stock to charity, which may also help reduce your tax bill.1

3. Deduct investment losses

While no one likes to lose money on investments, there is an upside. You can deduct some losses from your taxable income. While this doesn't generally apply to retirement accounts, you can sell other investments, such as stocks and bonds, for less than you paid to potentially lower your taxes. This is also known as “tax loss harvesting.” Check with a tax professional for details.

This tip applies to investment property, too. If you sell a property for less than its purchase price, you can deduct the loss. However, this doesn’t include personal property you use, such as your primary home.

Other options that may be available

4. Pay your property taxes early

If you own a home, paying your property taxes before they’re due may reduce your taxable income. Be sure to talk to your tax preparer to determine whether this strategy makes sense for you.

5. Use mortgage-interest deductions

Depending on where you live, you might be able to deduct interest you pay on the mortgage for a home you live in all or most of the time, up to certain limits. This applies only if you itemize deductions on your tax return.

Consult a tax professional

There are many ways to reduce your taxes by investing in yourself, your future and your community. Consider talking with a tax preparer to learn how to make the most of these tax savings opportunities and others.

Enroll in your retirement plan or increase your contributions today.

To learn more about financial wellness concepts and improving your retirement readiness through your employer-sponsored retirement plan, visit our resource center.

1 “Publication 526 (2021), Charitable Contributions,” IRS.gov (March 2, 2022).

2 “Topic No. 409 Capital Gains and Losses,” IRS.gov (May 19, 2022).