The hardest part is getting started

1. Consider your reasons

2. Create a budget

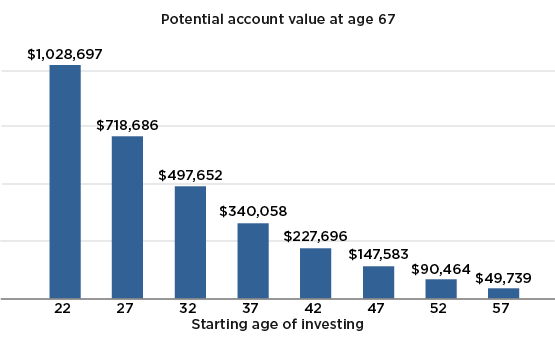

3. Start saving early

4. Pay yourself first

5. Focus on debt

Remember, small steps have a big impact

Ready to put the "pay yourself first" idea into practice? Enroll in your plan or increase your contributions today.