Renters insurance

Renters insurance coverage

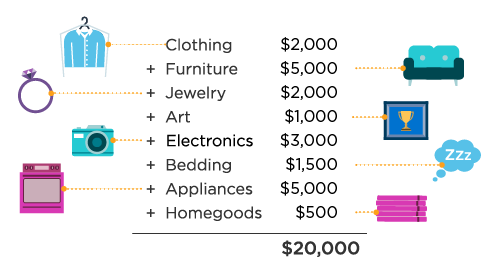

What does renters insurance cover?

Basic renters insurance coverages

Optional renters insurance coverages

Other policies to consider

Auto insurance

Lots of auto insurance companies can give you a quote. But we back it up with our superior claims team.

Get car insurance